ACH Transactions Demystified: Key Information and Best Practices

Key Takeaways

- ACH transactions are a versatile and efficient way to handle digital payments.

- Understanding ACH can help businesses optimize their financial operations.

- ACH transactions offer benefits such as cost-effectiveness and reduced paper use.

Table of Contents

- Understanding ACH and Its Importance

- How ACH Works: Behind the Scenes

- Benefits of Using ACH Transactions

- ACH vs. Other Payment Methods

- Everyday Use Cases for ACH Transfers

- Tips for Businesses Utilizing ACH

- The Future of ACH Transactions

Understanding ACH and Its Importance

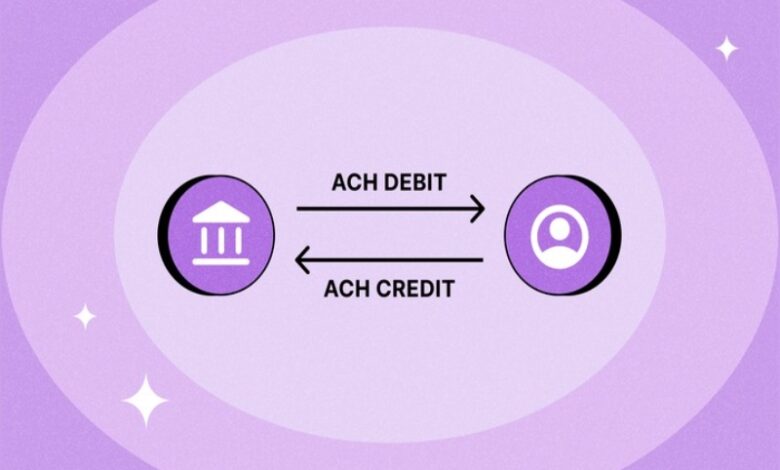

The Automated Clearing House (ACH) network is crucial in digital finance, allowing individuals and businesses to send and receive payments quickly. As an electronic center, ACH handles various transactions, such as direct deposits, vendor payments, and government payouts. The convenience and reliability of the ACH network have led to its widespread adoption across various sectors. Understanding the ACH transaction categories is crucial for those looking to navigate the complex landscape of digital payments. This knowledge fosters a comprehensive grasp of ACH functionalities and benefits.

Notably, the ACH system offers a structured framework that helps businesses efficiently manage both inflows and outflows of money. It reduces administrative costs and minimizes the risk associated with handling physical checks. Furthermore, in an age where digital transformation is reshaping industries, the security and efficiency of ACH transactions make them an integral part of contemporary financial operations. It empowers businesses to optimize workflows, reduce manual processes, and focus more on core activities that drive growth.

How ACH Works: Behind the Scenes

The ACH network’s heart is its batch processing system, which groups financial transactions, facilitating a simultaneous and efficient transfer process. This operation typically concludes within one to two business days, providing convenience unmatched by traditional methods. While real-time systems have gained some traction, the ACH batch-processing approach remains popular for its cost-effectiveness and simplicity.

The intricacies of ACH involve multiple players, including originating banks, receiving institutions, and intermediary clearinghouses. Each has distinct roles, responsibilities, and regulatory guidelines to ensure seamless and secure fund transfers. Understanding this network’s inner workings highlights why ACH remains a preferred method for numerous financial transactions. A detailed Investopedia article dives deeper into the structure and processes behind ACH, providing valuable insights for those interested in the nuances of financial technology.

Benefits of Using ACH Transactions

- Reduced Fees: Compared to other financial transaction methods, ACH commonly incurs lower fees, making it a cost-effective choice for businesses, especially when handling large volumes of transactions. This advantage is crucial in helping organizations maintain a healthy bottom line.

- Improved Security: The ACH network is regulated by stringent standards that safeguard sensitive information, minimizing the risk of unauthorized transactions. This degree of security is crucial for preserving trust and credibility with clients and business associates.

- Environmentally Friendly: By significantly reducing the reliance on paper checks, ACH supports eco-friendly business practices. Companies prioritizing sustainability can leverage ACH’s environmental benefits to align with their green initiatives.

- Time Savings: ACH’s automation capabilities streamline payment processes, significantly reducing the time required for manual interventions. This efficiency is particularly beneficial for high-volume transactions like payroll, where timely disbursement is critical.

ACH vs. Other Payment Methods

Businesses often weigh the trade-offs between cost, speed, and reliability when selecting a payment method. ACH stands out as a highly economical option compared to alternatives like wire transfers and checks. While wire transfers deliver instant transactions, they come at a premium cost that may only be feasible for some business needs. Conversely, checks, although traditional, involve manual processing and longer clearing times, making them less appealing in a fast-paced digital world.

The advantages of ACH become more pronounced in scenarios requiring consistent and predictable payments, such as automated billing cycles. By choosing ACH, businesses can better manage cash flow, minimize transactional costs, and enhance operational efficiency. This ability to maintain a streamlined financial operation positions ACH as a strategic asset in business finance management.

Everyday Use Cases for ACH Transfers

- Payroll: ACH facilitates seamless direct deposit services for employee salaries, providing reliability and cost efficiency that manual payroll systems lack. By leveraging ACH, companies can optimize payroll processes and enhance employee satisfaction with timely payments.

- Vendor Payments: Utilizing ACH for vendor transactions ensures quick, accurate, and traceable payments, fostering strong supplier relationships. This mitigation of payment delays is key for businesses that maintain a smooth supply chain.

- Customer Billing: For frequent billing situations, such as utility services or subscription fees, ACH is an ideal solution. It allows for automated, secure, and convenient processing that benefits both the business and its customers.

Tips for Businesses Utilizing ACH

Integrating this payment method with comprehensive accounting software is crucial. This integration simplifies financial record-keeping and enhances accuracy in transaction tracking, thus facilitating better decision-making. By automating these processes, businesses can reduce human error, ensure timely reconciliation, and maintain transparent financial records. Security remains a pivotal concern; hence, implementing robust cybersecurity protocols is necessary for protecting sensitive information. Encryption, two-factor authentication, and regular audits can bolster a company’s defense against data breaches and fraud. For more in-depth strategies, a comprehensive Forbes guide offers many practical tips tailored to businesses seeking to maximize ACH’s advantages.

The Future of ACH Transactions

Looking ahead, the future of ACH transactions appears promising due to ongoing technological progress and a rising need for effective digital payment solutions. Innovations such as same-day ACH have already introduced expedited processing times, broadening the appeal and flexibility of ACH methodologies. As digital transformation influences the financial sector, the ACH network is expected to evolve further, integrating with emerging technologies like blockchain and AI to enhance capabilities. These developments promise to offer more robust and adaptable solutions, making ACH an even more integral component of the digital economy. By staying agile and embracing these advancements, businesses, and consumers can remain at the forefront of financial innovation and efficiency.